Archer Introduces Comps Dashboarding: The Most Comprehensive Rent and Expense Benchmarking Tools for Multifamily

Note: Comps Dashboarding is currently in Beta. Clients currently in Beta Program have access. If you'd like early access, please reach out to your Archer Support team.

Archer, the leading real estate investment intelligence platform, today announced the launch of its Comps Dashboard, a revolutionary new feature designed to help real estate professionals automatically build and analyze rent and expense comps.

For the first time, investors, asset managers, and lenders can instantly benchmark their properties against a massive proprietary dataset while dynamically incorporating their own rent rolls (RRs) and trailing 12-month financials (T12s) to refine comps over time.

With nearly 200,000 rent comps and nearly 250,000 financial docs powering our expense comps available at launch, users are never starting from scratch. Whether evaluating a new market, underwriting a deal, or auditing property performance, Archer provides a complete dataset from day one—eliminating the need to piece together external data sources.

The Challenge of Market Analysis in CRE

Real estate professionals rely heavily on comparative market analysis to make informed decisions about rent pricing, renovation strategies, and competitive positioning. However, existing solutions often lack depth, requiring users to pull fragmented data from multiple sources and manually process it. This results in inefficiencies, outdated insights, and missed opportunities.

Traditional comp analysis tools focus almost exclusively on rent data—but real estate performance is about much more than rent. CRE professionals need a full financial picture, including:

✔ Rent Comps: Market trends, unit-level analysis, and renovation impact on rents

✔ Expense Benchmarking: Operating expenses (taxes, insurance, maintenance, payroll, marketing, etc.) compared against actual property performance

✔ Other Income Comps: Parking fees, pet rent, utility reimbursements, and ancillary revenue streams

Additionally, users often need to answer highly specific financial and strategic questions, such as:

- How does a given property stack up against comparable properties in rent and expense metrics?

- What trends, opportunities, and risks exist within a property’s financials?

- How can comp data validate underwriting assumptions for lenders or owners?

- What sale comps support or challenge an owner's price expectations?

- How do millage rates and property taxes compare across assets to justify tax appeals?

- How can financial benchmarking help create a development or stabilization plan from scratch?

Existing legacy solutions sometimes provide aggregated market data, but they don’t show individual property-level comparisons or allow users to engage with the underlying properties that make up those benchmarks. Archer changes that by providing Rent and Expense benchmarking at a property-by-property level for hundreds of thousands of properties out-of-the-box, and by enabling users to seamlessly incorporate every Rent Roll or Operating Statement they analyze as part of their unique, proprietary data set with no additional work.

The Most Comprehensive Benchmarking Tool for CRE

Archer's Comps Dashboard eliminates these challenges by allowing users to blend their proprietary data x Archer’s extensive dataset, creating the most accurate and actionable comp analysis in the industry.

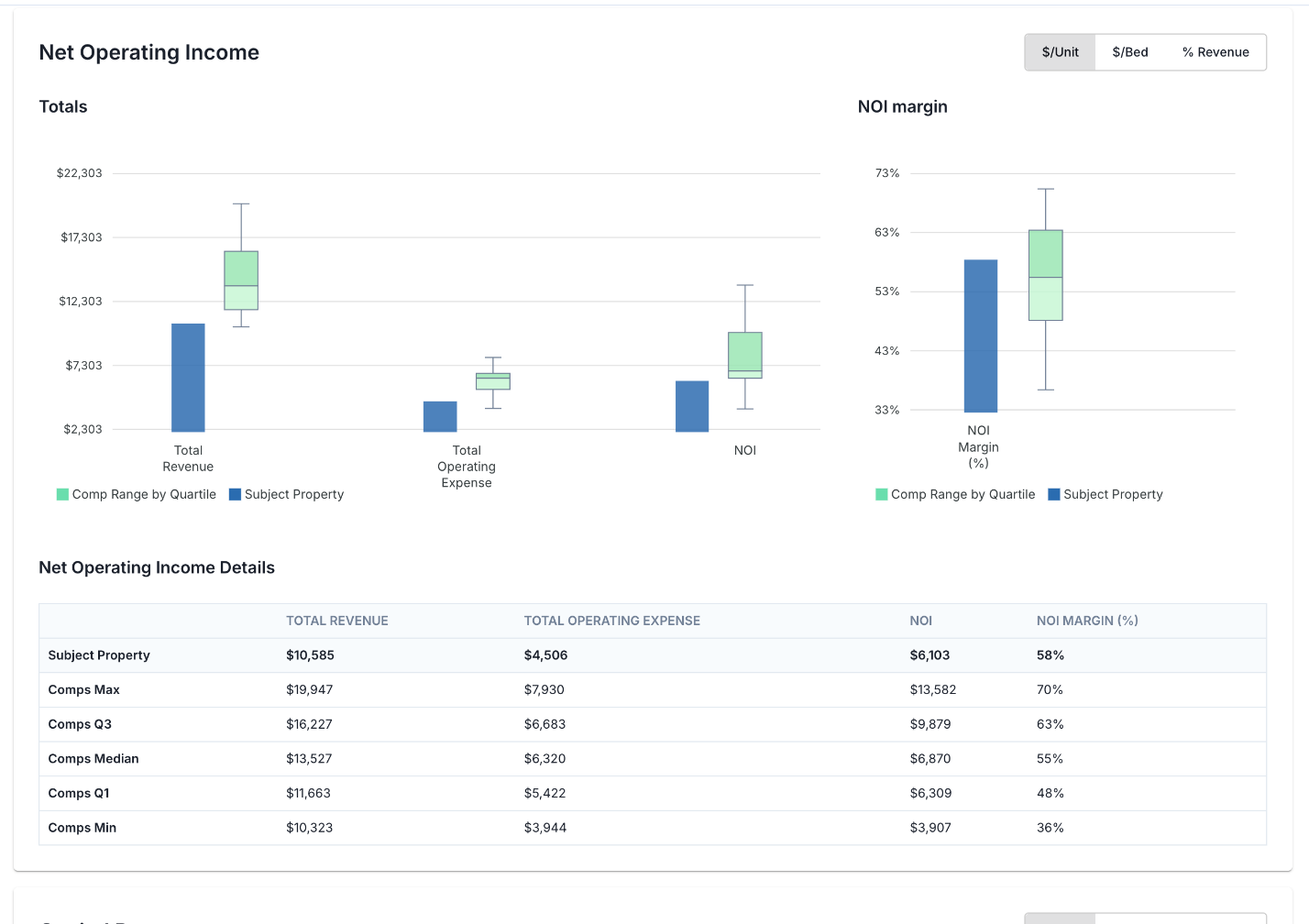

The Comps Dashboard centralizes and automates comparative property analysis, giving users instant access to critical data points, including:

- Geographic Trend Analysis: Search a given area (by zip code, submarket, radius, or market) to understand high-level rent, income, and expense spreads.

- Multi-Area Comparisons: Compare two or more areas against each other to assess market performance.

- Subject Property Deep Dive: If property data is available (Rent Roll or T12), compare its performance against likely comps and audit its internal trends and risks.

- Comp-Based Property Insights: If no subject property data exists, Archer can build a predictive underwrite for that property based on historical data and area comps to gauge its likely positioning.

- Financial Benchmarking: Validate underwriting assumptions for lenders, owners, or development plans using full income and expense comps.

- Sale Comparisons: Showcase price justification insights based on recent transaction comps.

- Portfolio Comparison: Connect your own portfolio of assets into the system to automatically factor your own internal performance into the benchmarks.

This data is sourced from Archer’s proprietary data sets, third-party integrations, and user-submitted custom comps, ensuring comprehensive and accurate market intelligence.

Steps to Success

- 1️⃣ Your Data Powers Your Benchmarking (Automatically)

- Every rent roll (RR) and T12 reviewed in Archer automatically builds a unique rent and expense dataset for the user.

-

- As users analyze more properties, their data moat grows, making Archer the most valuable benchmarking tool in their portfolio.

- 2️⃣ Market Data at Your Fingertips – No External Sources Required

- Even if users are new to a market or evaluating a property they don’t own, Archer provides instant access to almost 200,000 rent comps and nearly 250,000 financial docs powering our expense comps—covering more markets with fewer resources.

-

- No need to hunt for third-party data—Archer delivers the insights immediately.

- 3️⃣ Rent Comps vs. Expense Benchmarking – A Differentiated Approach

- Rent comps are standard in the industry, but Archer is one of the only platforms offering true expense benchmarking.

-

- Expense comps are fully interactive, allowing users to see individual properties that contribute to benchmarks rather than just receiving a spread (high/low estimates).

- 4️⃣ Property-Level Engagement & Customization

- Users choose which properties are included in their analysis—ensuring transparency and control over benchmarks.

-

- Compare not just existing comps, but also value-add comps to validate renovation planning and rent uplift potential.

What Feels Like Magic is Now the Standard

- 🚀 Benchmark Insurance Costs by Submarket

- 📈 Audit Property Manager Performance – Compare your property’s financials against third-party expense and income estimates to ensure you’re maximizing profitability.

- 🔎 Validate Seller Financials Before Buying – Compare a seller’s provided T12 against known comps to ensure underwriting accuracy, identify potential risks or opportunities in how the property is currently being managed.

- 🛠 Confirm Renovation Plans with Value-Add Comps – Analyze rental uplifts from renovated properties to verify post-renovation rent projections.

- 🏢 Assess Property Tax Liabilities – Pull millage rates and actual property tax payments to challenge unfair assessments.

- 📊 Create Data-Backed Development Plans – Use full financial benchmarking to model stabilized asset performance.

Why This Matters

- ✅ Users don’t start from scratch – Archer provides a massive dataset from day one, covering both rent comps and expense benchmarking.

- ✅ Every interaction builds value – The more users analyze properties, the more their custom comps and expense data moat grows.

- ✅ Transparency and control – Unlike other platforms, users engage directly with property-level data, not just broad market averages.

- ✅ End-to-end analysis – Archer enables seamless navigation from high-level market trends to granular property-by-property comparisons, all in one place.

- ✅ Fully exportable insights – Easily share benchmarking reports with lenders, investors, and stakeholders—spreading Archer’s brand in the process.

- ✅ Streamlined Process of Asset Management - No longer a requirement for an acquisitions team to pull their asset management team into the process of getting a benchmark study done, let Archer do the hard work for you.

Key Benefits for Real Estate Professionals

- Enhanced Decision-Making: Quickly evaluate how a property’s performance compares to similar properties in the market, enabling more strategic pricing and investment choices.

- Time Savings: Eliminate the need for manual data gathering and processing by accessing all relevant market data in one centralized dashboard.

- Granular Insights: Drill down into rent trends, occupancy fluctuations, and financial metrics with dynamic filtering and visualization tools.

- Customizable Comparisons: Compare subject properties against a curated selection of comps, tailored to specific market research needs.

- Visualized Data: Leverage intuitive charts and dashboards to interpret trends and support data-driven discussions with stakeholders.

- User Data Empowerment: See the size, scope, and value of stored custom comps with visibility into the count of user-generated comp properties (e.g., # Financial Comps, # Rent Comps).

- Smart Data Visibility Controls: If a user selects “Only Show My Data” but sees limited results, a smart prompt suggests broadening the search to access more comps.

- Seamless Workflow Navigation: Move fluidly from high-level comp spreads by geography → comparison of comps vs. a single property → selective comp inclusion/exclusion → deep analysis of a particular property → making that property the new subject property for further analysis.

- Exportability and Branding: Easily export and share comp analytics with Archer branding, increasing visibility beyond the customer base.

FAQs: What You Need to Know

Q: How does the Comps Dashboard automatically build benchmarking data?

A: Every rent roll (RR) and trailing 12-month (T12) financial statement a user reviews automatically adds to their private dataset—providing an expanding, customized benchmarking tool.

Q: What if I don’t have my own comp data yet?

A: Archer provides access to almost 200,000 rent comps and nearly 250,000 financial statements powering our expense comps, so users can immediately benchmark properties—even in markets they don’t already own in.

Q: What’s the difference between Rent Comps and Expense Benchmarking?

A: Rent comps analyze asking rents and rental trends. Expense benchmarking provides operating expense data (insurance, payroll, utilities, maintenance, etc.), making Archer’s dataset far more comprehensive than standard Rent Comp tools.

Q: Can I compare individual properties, not just broad market averages?

A: Yes! Unlike competitors, Archer lets users interact with individual properties—so you see what’s behind the benchmarks instead of relying on aggregated data spreads.

Q: Can I include or exclude properties from my benchmarking analysis?

A: Absolutely! Users have full control over which properties are included, allowing for highly customized comparisons.

Q: Can I use this data to validate underwriting assumptions?

A: Yes. Users can compare seller-provided T12s and rent rolls against known comps to confirm financial projections before investing.

Q: Does the Comps Dashboard help with renovation planning?

A: Yes! Archer’s value-add comp analysis allows users to compare pre- and post-renovation rents and expenses, ensuring accurate renovation uplift projections.

Q: Can I export my comps analysis?

A: Yes! Archer enables users to export, share, and present benchmarking data with branded reports, helping spread Archer’s insights beyond its platform.

Q: Is my data shared with other Archer users?

A: No! Any data that you or your team uploads, from Rent Rolls, T12s, Underwrites or other documents is only shared among your team and is not used to enhance the Archer dataset for other users.

Q: How do I get started with the Comps Dashboard?

A: The feature is available now in Archer’s platform. Simply log in, navigate to Comps Section, and start exploring Markets or Individual Properties.