From Pencils Down to Deals Up: Winning when Most are on the Sidelines

The commercial real estate (CRE) landscape has transformed rapidly. With the bid-ask gap widening due to rising interest rates, transactions have dipped. But how does one navigate this downturn? Archer offers unique insights to chart a path to success amidst the chaos.

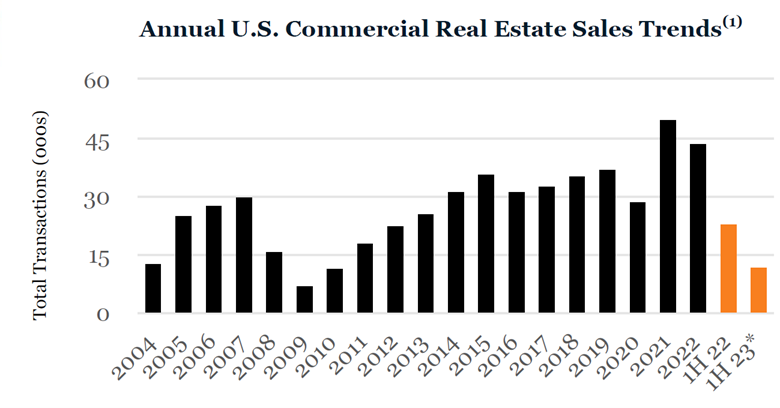

Source: Sources: Real Capital Analytics, * Preliminary estimate for market sales, Excludes STORE Capital acquisition in 1Q 2023, (1) Includes sales $2.5 million and greater for multifamily, retail, office, industrial, hotel, seniors housing, and land

The commercial real estate (CRE) industry has been on a roller-coaster ride over the past few years. While the last decade has witnessed an average of 30,000 transactions annually, 2021 and 2022 saw a surge to 45,000 transactions. Come 2023, a rapid rise in interest rates has pushed the bid-ask gap further apart, leading to a drastic 50% dip in the number of transactions. Early data hints at an annual tally of around 20,000 transactions for 2023.

It's Much Harder Out There to Get Deals Done

While many in the CRE space might view these figures with apprehension, Archer's perspective is refreshingly different. Our platform insights reveal that even in this downturn, more deals are getting done than one might expect, but it undoubtedly requires a more meticulous approach. Archer's unique perspective is rooted in seeing the current chaos as a golden window of opportunity, provided one has the right tools.

Finding a transactable deal right now is like finding a needle in a haystack."

– National Private Equity Fund

From 50 Deals to 250 Deals to Close

It's evident that making a deal pencil in today's landscape is a Herculean task. Based on feedback:

- For every deal they win, investors normally underwrite between 50-100 potential deals.

- In the current challenging market, this ratio has skyrocketed to 250+ underwrites for each closed deal.

"We’re pencils down until we start seeing more transactable transactions."

– Local Operator

Yet, amidst these daunting numbers, Archer's clients have stories of success to share. One such story revolves around a client who contemplated hiring additional analysts to manage the rising workload but chose Archer's robust platform instead. The result? Greater confidence and a significantly higher number of processed deals, all with the same team.

Pioneering Features: Bulk Underwriting

One of Archer's game-changing offerings is the "Bulk Underwriting" feature. Tailored for current market challenges, it stands as a testament to our commitment to clients:

- Allows clients to comprehensively underwrite hundreds of properties swiftly.

- A boon for investors, brokers, and lenders who grapple with distressed portfolios, devoid of the requisite tech and resources.

"We are seeing these distressed portfolios come out, but we are completely understaffed to be able to flex up to underwrite these deals the time needed."

– Debt Fund

Metrics Speak Louder Than Words

Archer's capabilities were on full display when we bulk underwrote a 375-property portfolio in under a day, calculating the Net Operating Income (NOI) with an impressive accuracy of 0.2% of actuals. In a landscape where a single deal typically takes a day to underwrite, this is nothing short of groundbreaking.

Another story includes a client who initially considering expanding their analyst teams due to workload but elected to join Archer. The outcome? More deals processed efficiently without team expansion.

"With Archer, we expanded our capabilities, not our team.

Today, we're bidding on more deals with higher confidence."

- Regional Family Office

User Experience: Evolution & Adaptation

Our clients' requirements have transformed during the downturn. Archer has not just observed but adapted:

- Evaluating Potential: With fewer transactable deals, Archer introduced the Bulk Underwriting feature, ensuring every deal on the market is evaluated.

- Uncovering Hidden Gems: With fewer marketed deals, Archer aids clients in identifying off-market opportunities ripe for acquisition.

- Portfolio Enhancement: For clients keen on enhancing their current investments, Archer's asset management analytics pilot is a game-changer.

Forecasting the CRE Horizon

Key external factors today include fluctuating economies, escalating interest rates, and surging insurance premiums. These challenges are reshaping real estate values and transaction dynamics.

The market might seem tumultuous, but Archer envisions vast opportunities lurking:

- Despite the relative drop in transactions, the volume remains substantial.

- Astute investors, capitalizing on market fears, are positioned to seize unprecedented returns.

Built for Real Estate Success: A Commitment Beyond Software

Our engagement extends beyond just software tools:

- Every Archer client benefits from multiple training sessions and consistent on-demand support.

- For clients with bespoke models, Archer seamlessly integrates its Add-In, ensuring flexibility.

- Our proactive approach is evident as we assist clients with extensive portfolio evaluations, amplifying their analytical capabilities.

- Archer's contract structure is symbiotic, accelerating growth while limiting overhead.