Product Updates from Archer: January 2024

This year, we'll be sharing to the blog details about all our exciting product developments on a monthly basis. We are committed more than ever to delivering value to our customers by assisting their investment underwriting process to win more deals.

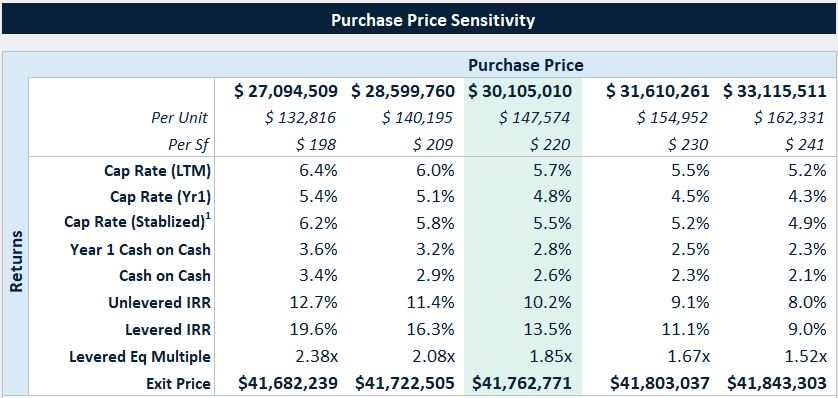

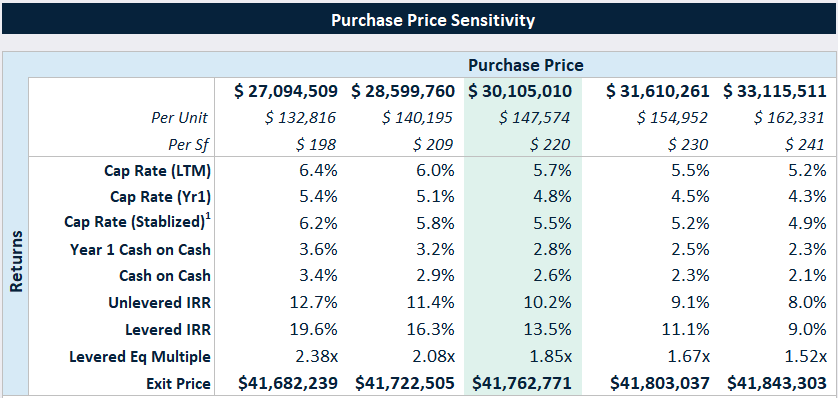

📈 Sensitivity Analyses Added to Underwriting Model

The Archer underwriting model now has a new sensitivity analysis tab to further analyze your financial projections. Click on the "Sensitivities" tab to view calculations to better understand your financial projections at different inputs and rates.

- Purchase Price Sensitivity on Returns

- Market Rent Sensitivity on Returns

- Exit Cap Rate Sensitivity on Levered Returns by Hold Period

- Loan Interest Rate Sensitivity on Levered Returns

- Renovation Rent Premium on Returns

- Renovation Cost Sensitivity on Returns

Example of one of the new sensitivity tables in the Archer Underwriting model

🌍 Introducing Global Underwriting Assumptions

You can now apply global underwriting assumptions so that key inputs can be applied to all new underwriting models.

Here's how it will help you:

- Global Reach: Create once, apply everywhere! Submit your key assumptions including market rent growth, leverage, interest rates, vacancy rates, hold period, exit cap rate, closing costs, targeted IRR and waterfall assumptions to apply them in any future model.

- Assumption Templates for Every Buy Box: Apply an assumption template associated with the capital partner or investment strategy on each deal you're underwriting.

- Save Time: Reduce repetitive data entry of all your underwriting assumptions in every model you create, so you can make decisions even faster than before.

- Consistency is Key: Ensure uniform assumptions across all your models, enhancing the reliability of your analyses.

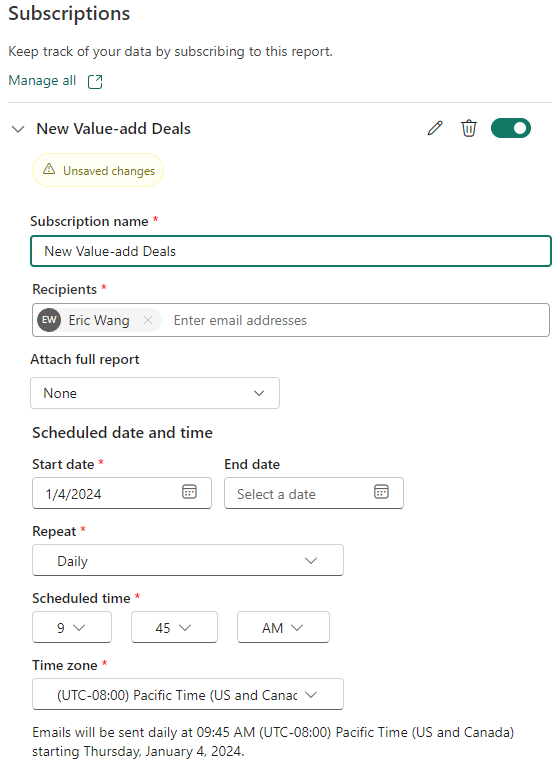

📬 Subscribe to Report in Investment Strategy Builder

Our Investment Strategy Builder (ISB) can monitor all new deal flow that's launched to the market and can track newly released properties that match your criteria. As a central command center, ISB allows you and your team to view, rank, and review these properties in one place, streamlining your underwriting process

Did you know you can subscribe to a report of new properties that come to market in your filtered search parameters? Use the Subscribe to Report feature to automatically request customized reports of new properties sent to your email inbox. These email notifications can be sent on a daily, weekly, or monthly basis at a time you prefer. Create as many reports as you'd like!

Want to learn more about how this all comes together? Schedule time with us through this link.

And make sure to watch this space 👀. We're building non-stop in 2024 and have exciting things to share every month!