Supercharging Portfolio Transactions with Archer's Rapid Underwriting

Unveiling Efficiency in Real Estate Analysis

Real estate investing, lending, and brokerage have traditionally been labor-intensive, especially when it comes to underwriting very large and/or distressed portfolios.

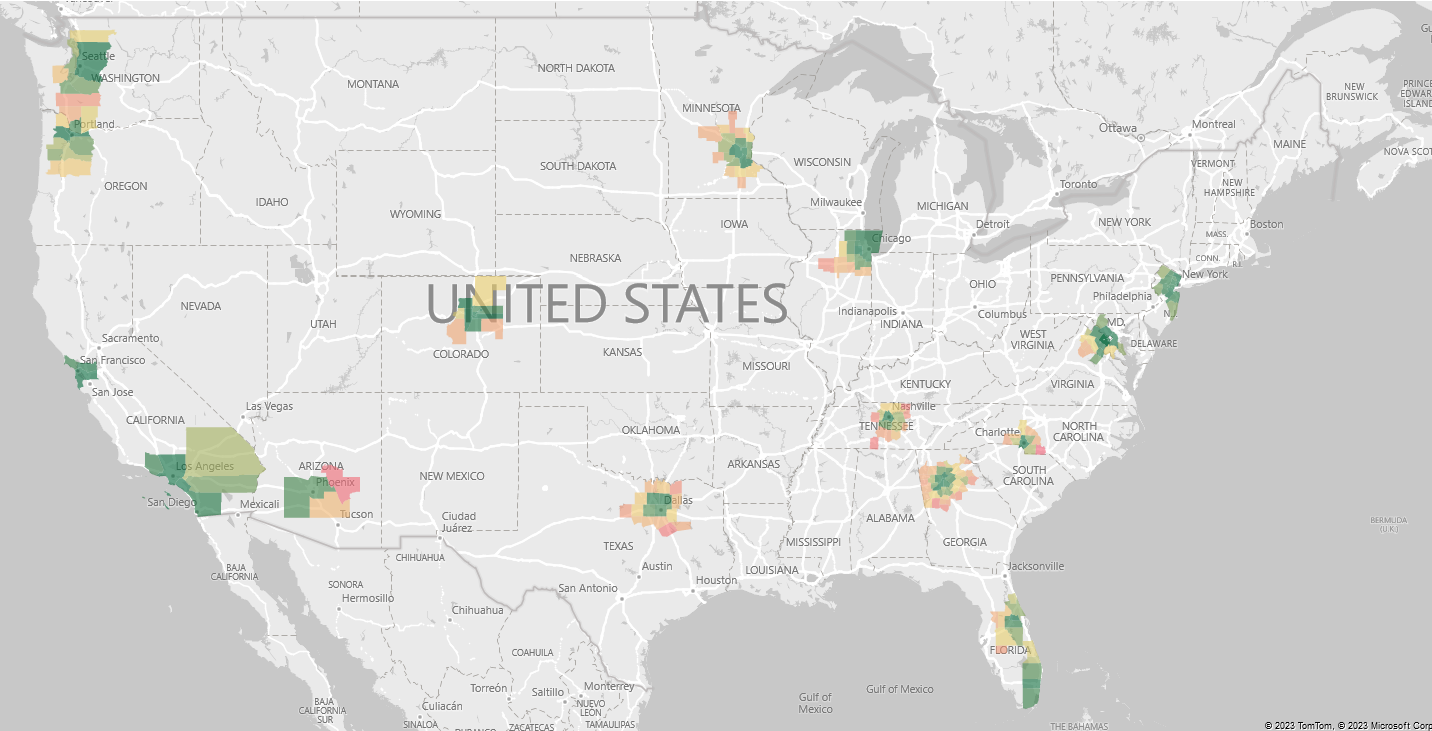

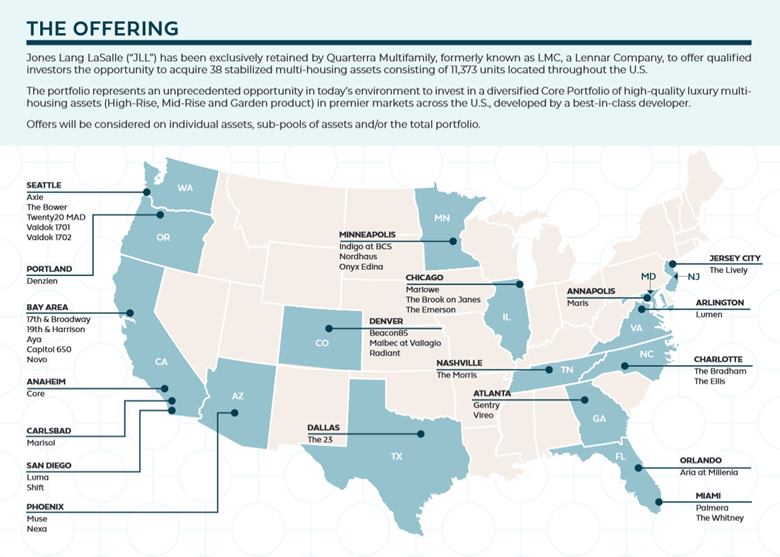

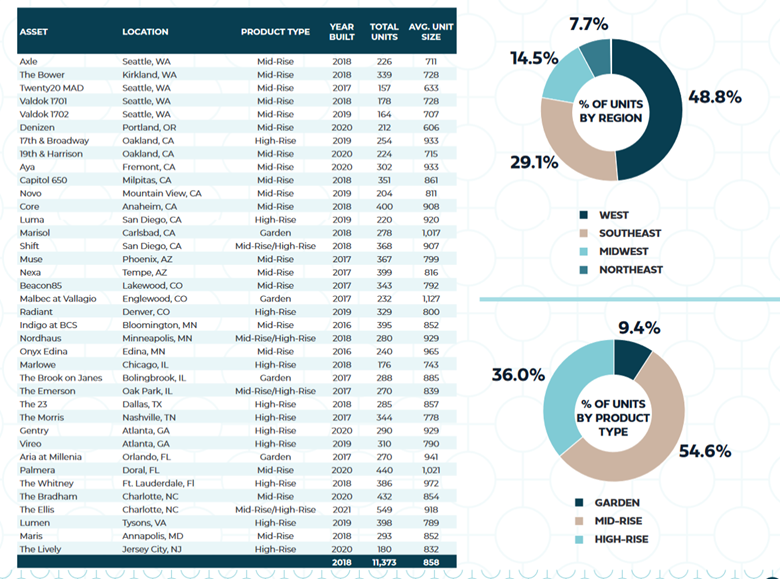

The recent launch of the Lennar portfolio, a massive collection of 38 assets across 15 states, exemplifies how traditional methods can be time-consuming and resource intensive. However, Archer's groundbreaking approach is redefining this process.

The Lennar Portfolio Challenge: A Case Study in Efficiency

Michael Busenhart from our team decided to put Archer's platform to the test with the Lennar portfolio, which was initially divided among multiple teams at JLL for disposition.

Using Archer's accelerated underwriting platform, we accomplished in just two hours what would have typically taken weeks for a massive team of analysts:

- Full parsing and underwriting of all 38 properties;

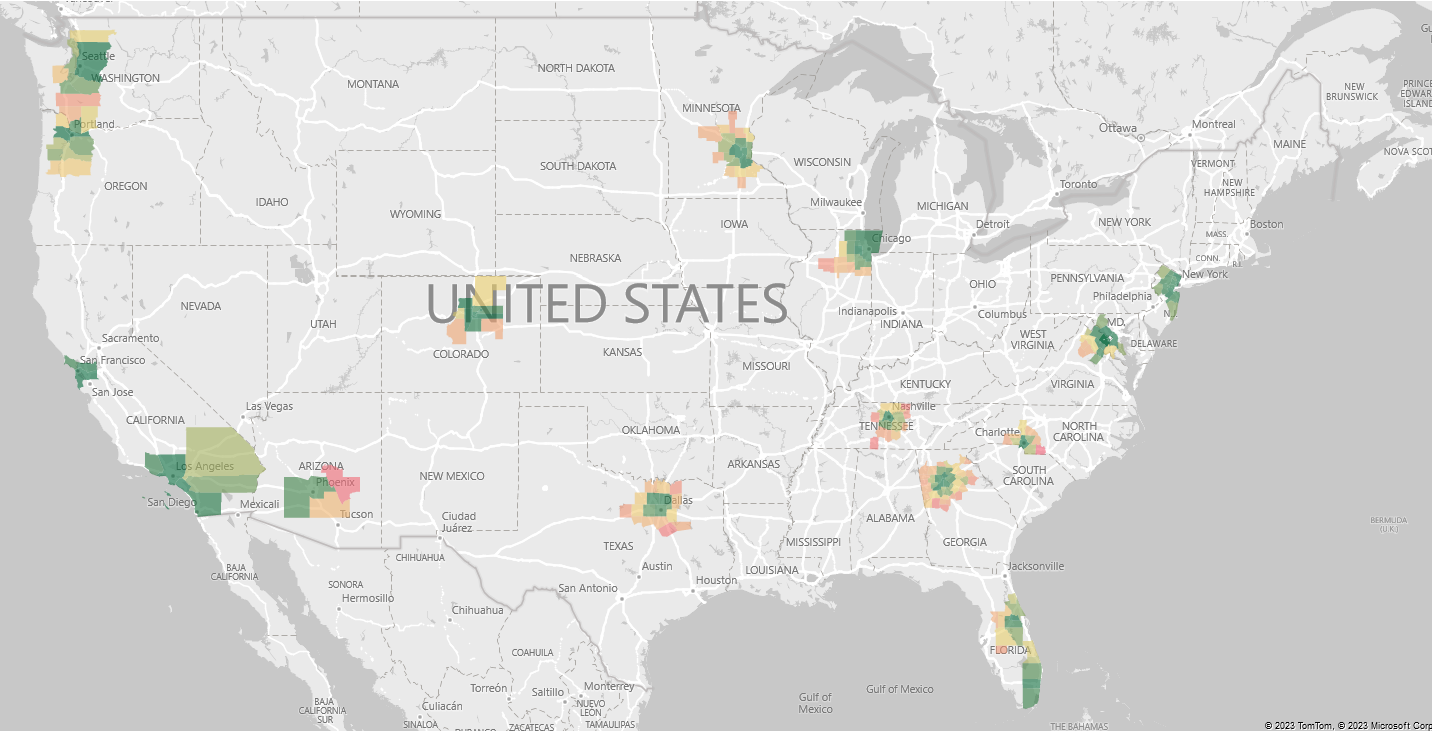

- Deep assessment of the portfolio's diverse metrics across different markets;

- High-accuracy predictive T-12 NOI, within a 5% variance (prior to parsing actual operating statements)

.png?width=1433&height=806&name=image%20(1).png)

Key Takeaways from Archer's Advanced Analysis

Archer's Investment Strategy Builder enabled us to swiftly identify and aggregate crucial metrics in the 95th percentile common across every market each property was in, such as:

- Access to Jobs by Transit

- Population Age 22-39

- Access to Parks

- Housing Units Renter Occupied

- Neighborhood Score

- Worked from Home Population (2yr Change)

.png?width=1693&height=1104&name=image%20(2).png)

This level of rapid, comprehensive analysis is a game-changer, particularly for large, complex portfolios.

Transforming Large Portfolio Underwriting Analysis

Through Archer's platform, the comprehensive analysis of the Lennar portfolio revealed:

- The ability to bifurcate information by market

- Creation of 15-year cash flow projections and scenario analysis

- Prediction of pricing based on market trends and expected returns

- Automatic compilation of rent, sales, and financial comps for each asset

Additionally, as rent rolls become available, they can be seamlessly integrated into the existing underwrite for further detailed analysis.

Targeting the Right Buyers with Precision

Similar to other large portfolios such as the Signature portfolio the final disposition often becomes segmented. Archer's system can also efficiently identify and rank the most suitable buyers for each asset group. This capability is invaluable for brokerage teams optimizing sales strategies and targeting the right market segments.

Special Offer for Prospective Archer Clients

We understand the challenges faced by teams in evaluating extensive portfolios like Lennar's. To support your efforts, we're excited to offer a special promotion for groups interested in leveraging Archer's platform for portfolio and distress transactions. This opportunity is designed to provide unparalleled insights and efficiency in your real estate transactions.

Reach out and see for yourself!