The Accuracy and Precision Paradox in Multifamily Real Estate Analysis

Why Getting it Right Matters More Than Ever

In the complex world of multifamily real estate analysis, the pursuit of accuracy and precision is paramount. While often used interchangeably, these two concepts represent distinct facets of the analytical process, each with profound implications for investment outcomes. Understanding the nuances of accuracy and precision, and how to achieve both, is crucial for navigating today's dynamic market and making informed decisions that drive success.

Accuracy vs. Precision: A Critical Distinction

Accuracy refers to how close a measurement is to the true value, while precision refers to how close repeated measurements are to each other.1 In the context of real estate analysis, accuracy is about getting the right answer, while precision is about getting the same answer consistently.

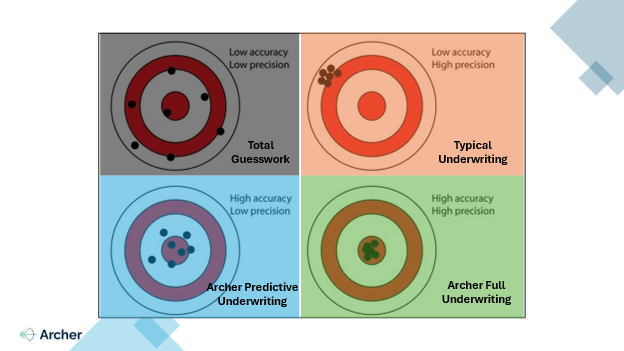

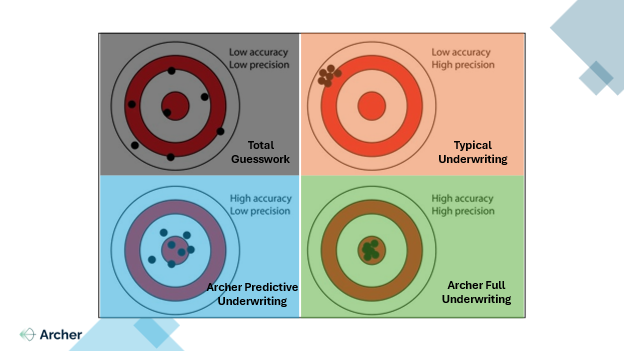

Think of it like throwing darts at a target:

- Top Left (Low Accuracy, Low Precision): This is akin to throwing darts blindfolded. Your analysis is essentially a guess, lacking sufficient data and a reliable framework. You're unlikely to hit the target, and even if you do, it's purely by chance.

- Top Right (Low Accuracy, High Precision): This is where the real danger lies. Imagine throwing darts with a faulty sight – your throws cluster tightly together, but they're all off-center. This scenario represents false confidence. You have some data and a seemingly consistent approach, but your analysis is fundamentally flawed, leading to potentially disastrous decisions.

- Bottom Left (High Accuracy, Low Precision): Now you're getting closer. Your darts land near the bullseye, but they're scattered. This represents a good starting point – your analysis is directionally correct, but you need more data and refinement to hone in on the true value. This is where Archer's Predictive Underwriting comes into play, providing a solid foundation for accurate analysis even with limited information.

- Bottom Right (High Accuracy, High Precision): This is the ultimate goal. Your darts consistently hit the bullseye. Your analysis is both accurate and precise, providing the confidence and clarity needed to make sound investment decisions. This is where Archer's Full Underwriting with Parsing excels, delivering precise and accurate results in minutes.

The Pitfalls of Traditional Analysis

Traditional real estate analysis often falls prey to the perils of false precision. Spreadsheets, while ubiquitous, are prone to human error and rely heavily on subjective assumptions. Outdated methodologies and incomplete data can further skew results, leading to a misleading picture of a property's true value and potential.

To be clear - the spreadsheet is not the problem - it's the false confidence of a spreadsheet when not understanding the level of depth.

This is particularly problematic in today's volatile market, where even minor inaccuracies can have significant financial consequences. Investors need tools and strategies that deliver both accuracy and precision to navigate uncertainty and make informed decisions.

Empowering Accuracy and Precision

Archer's platform is designed to address these challenges head-on, providing CRE professionals with the tools and data they need to achieve both accuracy and precision in their analysis.

- Predictive Underwriting: Even with limited data, Archer's Predictive Underwriting provides accurate insights into property performance. Our sophisticated algorithms leverage millions of data points to generate reliable estimates, even in the absence of rent rolls or T12s. One backtesting test for a national property management firm on ~375 of their properties demonstrated a remarkable 0.2% delta on NOI predictions, showcasing the power of our predictive capabilities. That is accuracy!

- Full Underwriting with Parsing: By automating data extraction and analysis, Archer delivers precise and accurate underwriting results in minutes. Our parsing engine seamlessly extracts key data from rent rolls and T12s, eliminating manual data entry and reducing the risk of errors. This data is then fed into our powerful underwriting engine, which generates comprehensive financial analyses with unparalleled speed and accuracy.

The Benefits of Accuracy and Precision

By achieving both accuracy and precision in your real estate analysis, you can:

- Make Confident Investment Decisions: Eliminate guesswork and rely on data-driven insights to guide your investment strategy.

- Mitigate Risk: Identify potential red flags and avoid costly mistakes by accurately assessing property performance and market conditions.

- Maximize Returns: Identify undervalued assets and optimize investment strategies to achieve superior returns.

- Gain a Competitive Edge: Outperform your competition with faster, more accurate, and more precise analysis.

The Future of CRE Analysis

In the dynamic world of commercial real estate, the ability to analyze deals with accuracy and precision is no longer a luxury, it's a necessity. Archer's platform empowers you to embrace a data-driven approach, unlocking new levels of efficiency, confidence, and success.

Don't settle for guesswork or false precision. Embrace the power of Archer and experience the future of CRE analysis.